Plywood Blog

A blog introducing information about Chinese plywood products and markets

How to find out the import and export tariff, VAT and other tax rates for China and the United States ?

How to find out the import and export tariff, VAT and other tax rates for China and the United States ?

If you do import and export business with China or the United States, it is necessary to find the import and export tax rate, value-added tax rate, anti-dumping tax rate etc before you starting your business.

How to find it?

Now the Internet is so convenient that these information can be easily obtained from the Internet.

How to find out China’s import and export tax rate ?

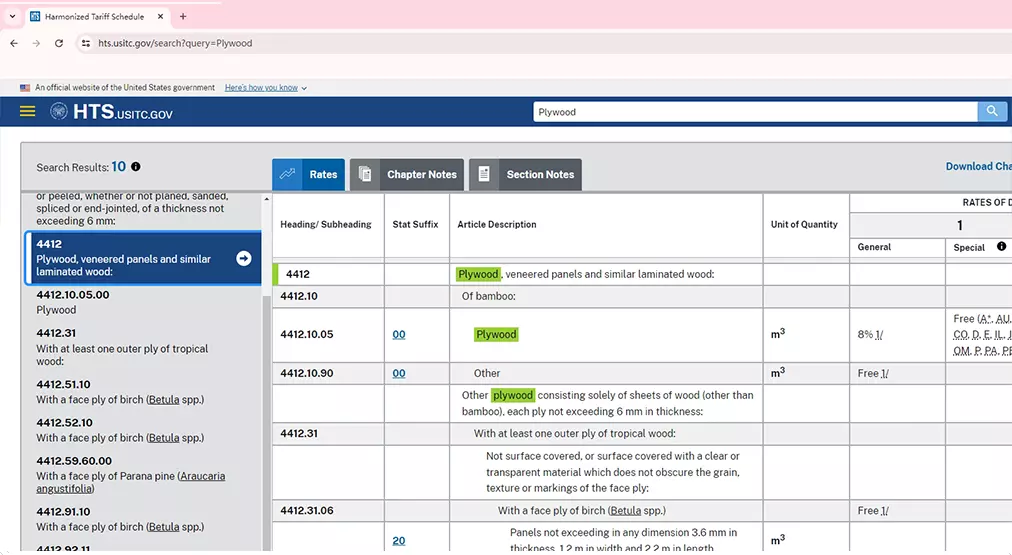

If you want to get China’s import and export tax rate, you can find it on this website: https://hs.e-to-china.com/

On this website, you can find the general tariff rate, MFN (most favored nation), Inspection & Quarantine, regulations & restrictions, anti dumping / anti subsidiary and some other important information

The following figure is a schematic diagram of searching for China’s plywood export & import tax rates:

How to find out United States’ import and export tax rate ?

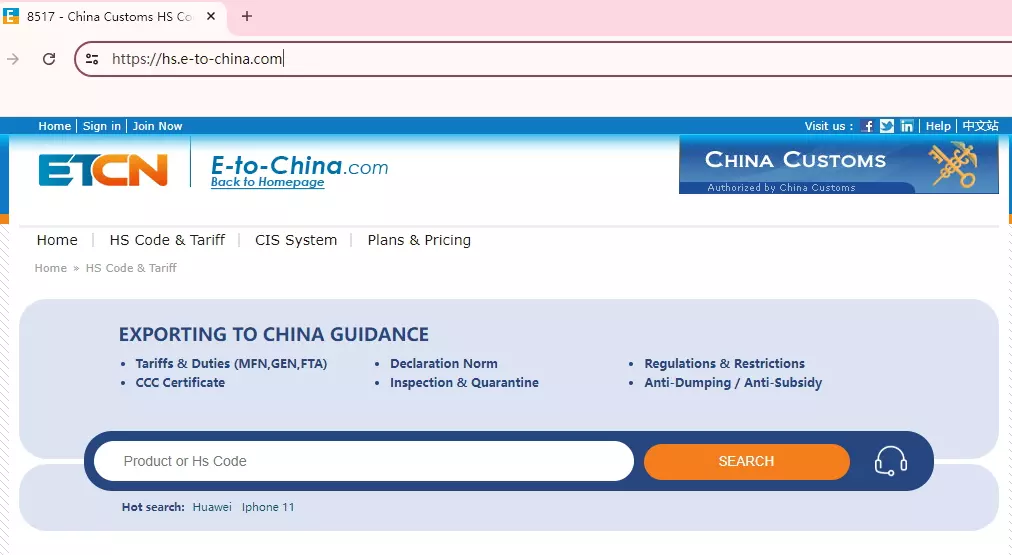

Similarly, if you want to check the U.S. import and export tax rates, you can find it on this website: https://hts.usitc.gov/

On this website, you can find out the product description, unit of quantity, rates of duty (general / special) and anti dumping rates by searching with the relevant product name or HS code.

The following figure is a schematic diagram of searching for USA’s plywood import & export tax rates: